Using the Additional Permitted Subscription (APS)

After her husband’s death, Caroline wished to consolidate his ISA portfolio with her own and protect its full value from inheritance tax.

The Client

Amongst the investments Caroline inherited from her husband, Roy, she received his ISA portfolio. Roy had been a real advocate of tax efficiency and, once they could afford it, they never missed an opportunity to utilise their annual ISA allowances. As a result, he had accrued a sizeable ISA portfolio spread across multiple providers. After his death, Caroline was keen to maintain her funds in their tax efficient wrapper. Initially, Caroline was worried that Roy’s ISA portfolio would lose its ISA status (and thus its tax efficiency) and she was concerned it would take several years of using up her own annual ISA allowance to move his sizeable portfolio across to her ISA portfolio. After speaking with her financial adviser, Caroline was delighted to find out a piece of legislation that would allow her to transfer the full value of her husband’s ISA portfolio into her own ISA account, preserving the tax efficiency that she desired. Her adviser went on to say that if she elected to transfer the value into an AiM portfolio service, it should qualify for Business Relief and 100% relief from IHT aftertwo years.

Our Solution

Caroline’s financial adviser explained that the legislation allowing her to transfer her husband’s ISA portfolio into her own is called the Additional Permitted Subscription or APS.

Key Features

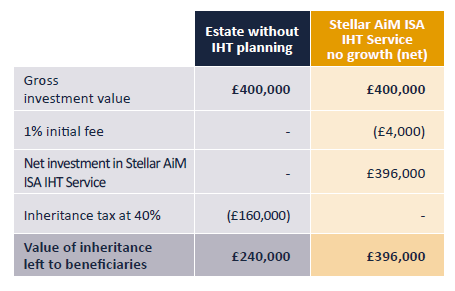

As the table below shows, even if the value of Charles’ ISA within the Stellar AiM ISA Inheritance Tax Service does not increase, his beneficiaries should still be able to save nearly £60,000 after all fees are paid, by not having to pay the 40% inheritance tax liability.

Result after 3 years

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Capital is at risk. Investments in unquoted companies are less liquid and are higher risk. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. This document is dated 10th September 2020 and is exempt from section 21 of the Financial Services and Markets Act 2000 and is not required to be and has not been approved for the purposes of the section because it is only being communicated to selected Investment Professionals (as defined under article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005). If this document is forwarded to any other person, you must ensure that you have taken responsibility for the document under the financial promotions rules and identified yourself as the issuer. Stellar Asset Management Limited of Kendal House, 1 Conduit Street, London W1S 2XA is authorised and regulated by the Financial Conduct Authority.