Tailored Strategy

“We want to explore the options available to reduce the inheritance tax bill that our two children may face.”

The Client

Anne and David have recently celebrated their golden wedding anniversary with their two children and eight grandchildren. They have an estate of approximately

£75 million.

They have a long-standing relationship with their financial adviser, Maddie. They have been selling other assets to provide funds for a range of gifts, trusts and other arrangements for their children and grandchildren.

They are also seeking assets that would qualify for relief from inheritance tax and which enable them to keep control over should they need these funds in the future. Maddie mentions Business Relief, in particular forests.

David’s family are from the Highlands of Scotland and he and Anne are very keen on the environmental benefit of forests. David and Anne are very keen on building a portfolio of forests within a personal trading company. They would like to invest independently of others to allow them full control of the timing of any sales.

Our Solution

With Maddie’s help Anne and David learned that forests should qualify for Business Relief (BR) and achieve 100% relief from IHT after two years.

After considering a range of BR options, Maddie selects the Stellar Bespoke IHT Service because it allows a bespoke solution to structuring the investment and selecting qualifying activities which suit their wishes.

The family is then on track to secure 100% relief from IHT for their children after two years, whilst investing in tangible assets which seek to preserve and grow their legacy. They are also reassured that should they need further capital in the years to come they will be able to sell a forest to provide the additional capital.

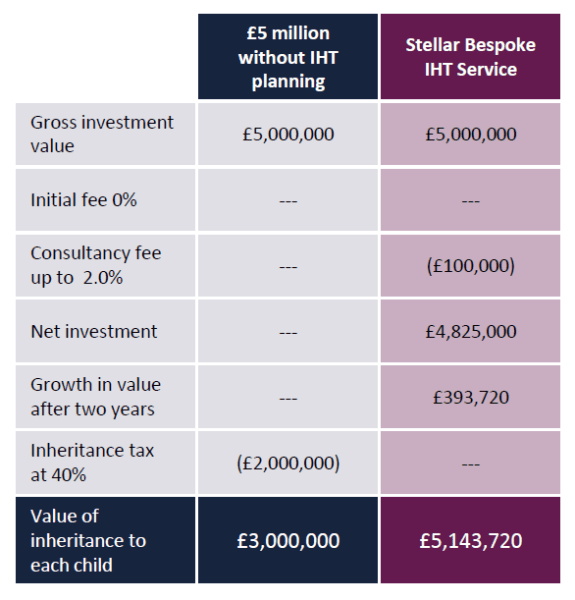

The following table illustrates the potential benefits of investing £5 million through the Stellar Bespoke IHT solution. We have assumed the underlying investments provide growth of 4% per annum after fees.

Result after 2 years

Important Information

Risk warning: Your capital is at risk. Investments can fall as well as rise and investors may not get back the full amount invested. Investments in unquoted companies are less liquid and are higher risk than larger companies. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. Please refer to the latest product literature before investing: your attention is drawn to the risks and fees contained therein.

This document dated 7th December 2022 is intended for retail investors and their advisers and has been approved and issued as a financial promotion under the Financial Services and Markets Act 2000 by Stellar Asset Management Limited (‘Stellar’). This document is for information only and does not form part of a direct offer or invitation to purchase, subscribe for or dispose of securities and no reliance should be placed on it. Stellar does not offer investment or tax advice or make recommendations regarding investments. Stellar is authorised and regulated by the Financial Conduct Authority (Firm reference No. 474710). Registered in England No. 06381679. Registered office: 20 Chapel Street, Liverpool L3 9AG.