Unstable markets have shifted focus to asset-backed investments

As we all continue to adjust to life under lockdown, most investors are grappling with volatile markets fuelled by the outbreak of coronavirus and the associated political, economic and social uncertainty.

Although risk mitigation is often a crucial factor for many clients when considering Inheritance Tax (IHT); current market conditions can make this difficult to achieve.

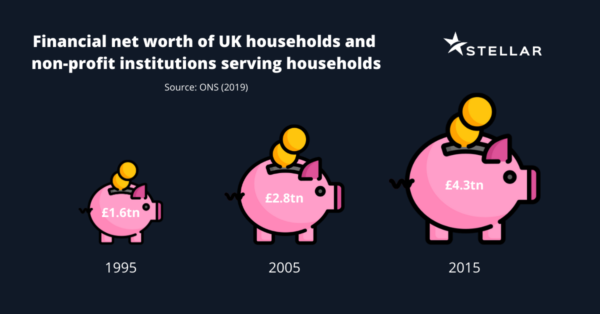

At the same time, average wealth in the UK continues to rise. Financial net worth held by UK households increased by 172% between 1995 and 2015 according to a 2019 ONS report.

At the same time, average wealth in the UK continues to rise. Financial net worth held by UK households increased by 172% between 1995 and 2015 according to a 2019 ONS report.

So, despite challenging market conditions, more people than ever will be looking to reduce their exposure to IHT. This means that investors could look outside of traditional methods when considering their IHT liabilities.

Time to consider asset-backed investments

With social and economic events impacting many traditional investment options, it can make sense to consider investments with performance that is less dependent on wider markets to achieve risk-adjusted returns.

One example of these is investing into Stellar Growth Inheritance Tax (IHT) Service.

One example of these is investing into Stellar Growth Inheritance Tax (IHT) Service.

This service is designed to provide risk mitigation as well as wealth preservation and capital growth for investors looking to leave a growing legacy, free from IHT.

The Stellar Growth IHT Service provides access to a range of qualifying business activities. These asset-backed investments offer security and diversification, in addition to qualifying for Business Relief.

Our highly diversified portfolio spreads the investment across multiple sectors. This helps to mitigate risk in a time of uncertainty both politically and socially.

For clients or investors seeking long term, stable projects as well as a range of other benefits, click here to find out more about our Stellar Growth IHT Service.

For more information, please get in contact on 020 3907 6984 or email enquiries@stellar-am.com

As with all investments, it is not without risk and investors should seek professional advice before

exploring this opportunity.