Residential Property Incorporation for IHT | Part One

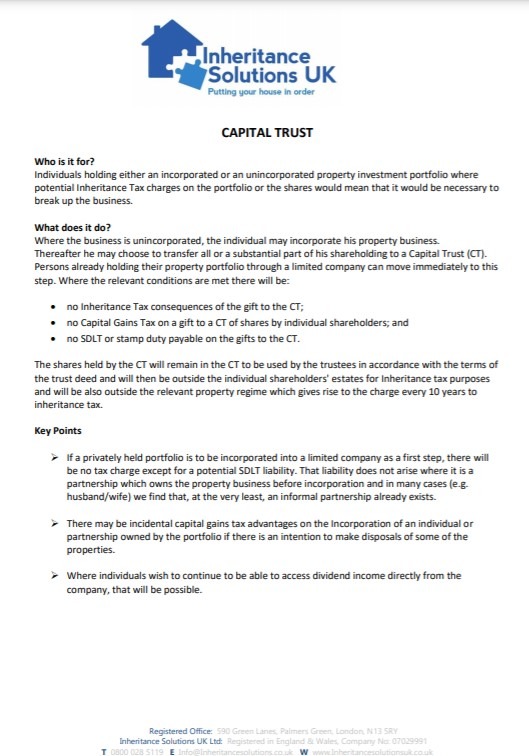

Hosted by our Corporate Director Matthew Steiner and Mark Mariou of Inheritance Solutions UK, this webinar examined the options available for advisers to support investors with buy to let portfolios of residential property.

This event was designed for financial advisers whose clients hold either an incorporated or an unincorporated property investment portfolio and who are seeking to reduce their exposure to Income, Capital Gains (CGT) and Inheritance Tax (IHT).

In this webinar, we covered the following themes:

- Background to the process

- Relevant legislation

- What constitutes a business

- New incorporations both when the portfolio is managed as a business or when it is not

- What options are available once incorporated

- Interplay with Business Relief

- Case studies