Legacy planning using tangible assets

How Simon and Emma protected their estate from IHT to leave a growing legacy to their children – with help from their financial adviser.

The Client

Simon and Emma are in their seventies and have an estate worth £1 million. As a married couple, their nil-rate band (NRB) allowances in respect of inheritance tax (IHT) amount to £650,000, meaning that their net estate of £350,000 could leave their family exposed to a potential IHT liability of £140,000.

Simon and Emma want to reduce their children’s exposure to IHT, and they want to invest in tangible assets that are simple to understand.

Our Solution

Having spoken to their financial adviser, Simon and Emma are keen to invest in Business Relief (BR) qualifying activities to achieve full IHT relief and reduce the liability their children will have to pay.

After considering many different BR options, their adviser recommended a service offered by Stellar which provided diversification from their existing investments and was asset-backed. The Stellar Growth Inheritance Tax Service invests in a portfolio of easy to understand assets like commercial forestry and hotels. Investments are made in their name, so they retain ownership of, access to, and control of their capital.

They should secure 100% IHT relief for their children after two years, whilst investing in tangible assets seeking to preserve and grow their legacy.

Key Features

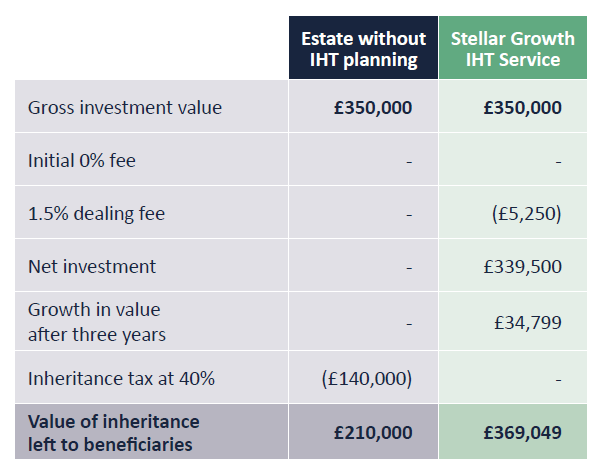

The table below illustrates the benefits sought from this solution, and we have assumed that the underlying investments provide growth of 5% per annum after annual fees – their children should receive an inheritance of £374,299, over 75% greater than if the capital was kept in cash and subject to 40% IHT.

Results after two years

Important Information

Risk warning: Your capital is at risk. Investments can fall as well as rise and investors may not get back the full amount invested. Investments in unquoted companies are less liquid and are higher risk than larger companies. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. Please refer to the latest product literature before investing: your attention is drawn to the risks and fees contained therein.

This document dated 7th December 2022 is intended for retail investors and their advisers and has been approved and issued as a financial promotion under the Financial Services and Markets Act 2000 by Stellar Asset Management Limited (‘Stellar’). This document is for information only and does not form part of a direct offer or invitation to purchase, subscribe for or dispose of securities and no reliance should be placed on it. Stellar does not offer investment or tax advice or make recommendations regarding investments. Stellar is authorised and regulated by the Financial Conduct Authority (Firm reference No. 474710). Registered in England No. 06381679. Registered office: 20 Chapel Street, Liverpool L3 9AG.