Consolidating ISAs on a Platform

How Eleanor consolidated her ISA investments on a wrap platform to achieve full IHT relief after two years.

The Client

Eleanor is an experienced investor and holds a variety of ISAs from different providers, these are a combination of investments she opened and others she has inherited from her husband when he died. Whilst these investments are held in a tax-efficient ISA wrapper, they are all subject to inheritance tax (IHT) and she is concerned by the large IHT bill her children will face when she passes.

Additionally, Eleanor is frustrated by the different fee structures and the inconsistency of reporting on her investments. She already holds some investments on wrap platform and is looking to move the others on platform to organise her portfolios.

Our Solution

Eleanor spoke to her financial adviser and she suggested that as Eleanor already held investments on the Transact platform, she has the option to move her other investments on to this platform.

Because of her large IHT liability, Eleanor’s adviser also suggested investing in the Stellar AiM ISA Inheritance Tax Service because this should provide full IHT relief after just two years.

Eleanor was able to make a transfer to the Stellar AiM ISA Inheritance Tax Service, which should qualify for 100% relief from IHT after only two years. This solution gives her access to, and control of, her capital whilst retaining all her ISA benefits.

Key Features

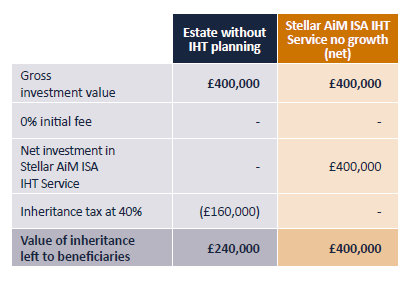

As the table below shows, even if the value of Charles’ ISA within the Stellar AiM ISA Inheritance Tax Service does not increase, his beneficiaries should still be able to save nearly £60,000 after all fees are paid, by not having to pay the 40% inheritance tax liability.

Result after 3 years

Important Information

Risk warning: Your capital is at risk. Investments can fall as well as rise and investors may not get back the full amount invested. Investments in unquoted companies are less liquid and are higher risk than larger companies. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. Please refer to the latest product literature before investing: your attention is drawn to the risks and fees contained therein.

This document dated 7th December 2022 is intended for retail investors and their advisers and has been approved and issued as a financial promotion under the Financial Services and Markets Act 2000 by Stellar Asset Management Limited (‘Stellar’). This document is for information only and does not form part of a direct offer or invitation to purchase, subscribe for or dispose of securities and no reliance should be placed on it. Stellar does not offer investment or tax advice or make recommendations regarding investments. Stellar is authorised and regulated by the Financial Conduct Authority (Firm reference No. 474710). Registered in England No. 06381679. Registered office: 20 Chapel Street, Liverpool L3 9AG.