Combining Business Relief and Trusts for Estate Planning

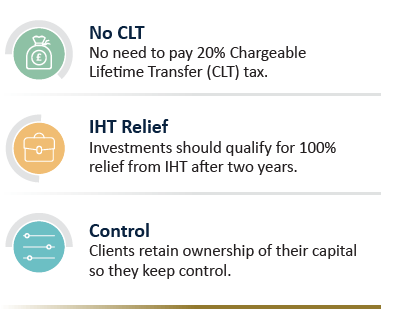

Richard and Jennifer invested in Business Relief qualifying assets. After two years they can decide whether to transfer to a Trust without paying a 20% chargeable lifetime transfer (CLT).

The Client

Richard and Jennifer are in their sixties, and their financial adviser has recommended that they start to consider inheritance tax (IHT) planning to maximise their children’s inheritance. Their adviser informs them that their estate is worth £3 million, which would mean a significant IHT liability of £940,000 after their nil-rate bands have been deducted.

Initially they were looking at trust based planning, but they were dissuaded by the 20% CLT for trusts over £325,000. They were considering gifting £1 million to a Trust, which would have meant an upfront charge of £200,000.

Their priority is wealth preservation, and they ideally want to avoid paying a 20% tax charge; especially as there is a possibility that their beneficiaries would have to pay further tax on their estate. Further tax would be due if Richard and Jennifer are not able to survive the seven years required for gifts to be free from IHT.

Their adviser suggested that if they were to invest their capital in Business Relief (BR) qualifying activities for two years, they could then review the situation and decide whether they wish to transfer their qualifying assets into a trust without being liable to the CLT charge. They are aware that they can continue to hold the assets free from IHT outside a Trust and retain ownership, access and control during their lifetimes.

Key Features

Trusts, Business Relief and CLTs

Trusts may be subject to CLT with a 20% upfront charge. However, if the investment is held in BR-qualifying business activities for two years prior to being transferred into a trust there is no CLT.

Our Solution

Stellar is a specialist in BR solutions and offers a range of services that allow investors to invest their capital into qualifying business assets. Richard and Jennifer chose to invest in the Stellar Growth IHT Service, because Stellar seeks wealth preservation and capital growth. The target net capital growth is higher than other BR providers and the Stellar Growth IHT Service offers greater diversification of asset classes, offering security for their investment.

Important Information

Risk warning: Your capital is at risk. Investments can fall as well as rise and investors may not get back the full amount invested. Investments in unquoted companies are less liquid and are higher risk than larger companies. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. Please refer to the latest product literature before investing: your attention is drawn to the risks and fees contained therein.

This document dated 7th December 2022 is intended for retail investors and their advisers and has been approved and issued as a financial promotion under the Financial Services and Markets Act 2000 by Stellar Asset Management Limited (‘Stellar’). This document is for information only and does not form part of a direct offer or invitation to purchase, subscribe for or dispose of securities and no reliance should be placed on it. Stellar does not offer investment or tax advice or make recommendations regarding investments. Stellar is authorised and regulated by the Financial Conduct Authority (Firm reference No. 474710). Registered in England No. 06381679. Registered office: 20 Chapel Street, Liverpool L3 9AG.