Last week, we proposed a scenario where a larger AIM IHT fund manager may have invested 2% of their portfolio in a £100m market cap. company. Should the need then arise for that fund manager to quickly exit that position (if that company has had a profit warning, for example), the manager will have to find a buyer for 30% of a listed company’s shares. Given liquidity AIM can often be very thin, even disposing of a 10% stake can be a hugely difficult ask. Liquidity is even harder to come by in times of crisis where, say, that company has already lost 50% of its value.

This inability to trade out of a stock in a matter of days, weeks, or even months can mean investors are locked into stocks that the manager would very much like to dispose of, compounding both the loss on the stock held and the opportunity cost of not being able to move those funds into a new, better idea.

It also greatly blunts the manager’s ability to react to and take advantage of the inherent volatility in share prices, where companies can become significantly overbought or oversold. By selling/reducing expensive companies and buying/adding to cheaper companies, Stellar is better positioned to capture this “rebalancing alpha” when the opportunity presents itself. By harvesting volatility in this manner, we can turn a perceived risk into an opportunity.

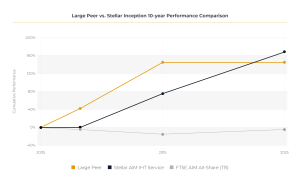

Since the beginning of 2008, the AIM market, as a whole, has posted a negative return to the end of June 2025. For AIM IHT providers who have run portfolios over this same period, the majority have provided their clients with triple-digit returns. AIM investment is one that demands skilled stock picking and portfolio construction, but we believe that the days of judging investment performance solely by reference to the benchmark is over. Relative returns offer insight, but absolute returns matter most.

The quality of the companies on AIM has improved dramatically over the past 20 years, and the reputation in the late 2000s/early 2010s for AIM being home to, in the main, a bevy of badly run companies was not without merit. In 2025, times have changed, and it is no longer possible to easily outperform the benchmark simply by herding into the largest AIM companies.

Performance as of 30 June 2025. Source: Stellar Asset Management, Industry factsheets

The above chart shows how the bulk of one of the largest AIM provider’s investment returns have stagnated since 2015, with almost all of their investment returns over that twenty-year period coming in the initial 2005 to 2014 period. At Stellar, despite our inception date in 2008 meaning our first decade missed 3 crucial years of performance compared to the large provider, noted above, we have demonstrated our ability to provide investment returns on a consistent basis.

The changes to the IHT rules should serve as a catalyst for investors and advisers to review their IHT mitigation schemes. Where AIM remains a suitable investment, which we believe it will do for a significant proportion of existing investors, it is vital that investors understand the structural reasons which could impact their investment returns moving forward, particularly with the reduced IHT relief available from 6 April 2026.

Stellar remains well-positioned to navigate the many challenges that inevitably rise as an equity manager. Our portfolio strategy is designed to allow us to stay nimble and take advantage of the pricing opportunities that arise at all levels of the market cap. spectrum. Our commitment to cap the strategy ensures investment integrity for existing and future clients both now and well into the future.

From a costing perspective, Stellar’s IHT Service is also cheaper than the aforementioned three largest providers from both a management fee and dealing perspective, and represents compelling value for money, even more so in light of recent performance.

We believe the time has come for investors to become much more discerning about how they invest on AIM, and we would welcome the opportunity to provide further information on how our investment strategy has resulted in such strong performance and how your clients can benefit from our service.

Switching AIM providers has never been simpler, and Stellar’s dedicated in-house transfer team are here to assist in making the process as easy as possible.

- Complete the form below and a member of our team will contact you to begin the transfer.

Once an application is submitted, Stellar’s dedicated in-house transfer team will manage the process, liaising directly with the ceding provider to make switching as smooth as possible. - Seamless Asset Transfers & Market Continuity

To preserve Business Relief (BR) qualification, assets can be transferred in specie with all necessary cost details for accurate CGT reporting. If stocks need to be sold, replacements are purchased the same day, ensuring clients are never out of the market and benefit immediately from Replacement Property Relief (RPR). - Cost-Effective Portfolio Rebalancing

With a low 0.25% dealing fee, rebalancing is affordable. Detailed illustrations provided before onboarding outline anticipated costs, and CGT ‘what if’ scenarios are available on request for added clarity.

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Prospective investors should ensure that they read the brochure and fully understand the risk factors before making any investment decision. The value of investments and the income from them may fall as well as rise and is not guaranteed. No assurance or guarantee is given that any targeted returns will be achieved. Forecasts of potential future results are not a reliable indicator of actual future results.

Stellar Asset Management Limited of 20 Chapel Street, Liverpool, L3 9AG is authorised and regulated by the Financial Conduct Authority.