In our first instalment we suggested that there was a direct link between the size of an AIM fund manager’s AUM and the performance outcome for those clients invested. As we made the claim, it’s only fair that we provide evidence to support this theory and, more importantly, explain what we do differently and why that matters.

There is a reason that we have picked the three largest providers on AIM to compare our performance against. As an AIM IHT manager with c. £100m of AUM, currently, we believe our biggest differentiator is our Go-Anywhere Ability.

Our “sweet spot” for investment in companies at around £250m market cap. or below tends be lower than our peers which has several key benefits:

-

It gives us a larger investable universe than many of our (larger) peers,

-

Those companies tend to be more attractively

-

priced than larger companies that may be on much higher P/Es,

-

Less crossover with other AIM IHT investors allowing us to be a strong portfolio diversifier while being less exposed to any ‘forced selling’ by peers

This small-cap bias also allows us to provide a double kicker to returns. By buying companies not yet on the radar of our larger-cap. focused peers, we can invest when they’re still trading on relatively lower Price to Earnings multiples (P/Es). As they grow their earnings, they become larger and thereby more coveted by larger investors who can now buy the stock, driving prices higher. And, when we get it right, as they re-rate to a higher P/E it is as a result of both sides of the equation, the ‘P’ and the ‘E’ rising, which gives us our double-kicker to returns. A stock that remains on a P/E of 10x that doubles it earnings will deliver a 100% return. If that same stock sees the P/E expand to 20x the return is amplified to 300%.

Throughout the past 5 years, we have traversed very different and incredibly volatile economic conditions. In 2021, we were in a low interest rate, low inflation environment, one very conducive to strong investment returns. 2022 saw Russia invading Ukraine, prompting sharp interest rate and inflation increases. As we acclimatised to the global geopolitical changes, we were thrown a domestic curveball in 2024 with the announcement of a general election, and subsequent changing of the BR rules in October 2024.

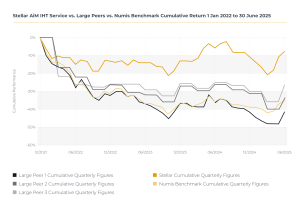

At Stellar, we are very proud of the performance of our AIM portfolio, particularly when compared to the larger AIM IHT providers. The below chart shows the performance of the Stellar AIM IHT portfolio from 1 Jan 2022 to 30 Jun 2025 against our benchmark, the Deutsche Numis Alternative Markets (ex. Inv. Co.) (TR), and the three largest AIM IHT providers by AUM.

Performance as of 30 June 2025. Source: Stellar Asset Management, Industry factsheets

Despite difficult market conditions, the Stellar AIM IHT Service (dark orange line) has significantly outperformed the benchmark (light orange line). Unfortunately, the same cannot be said for the three largest providers on AIM, who have either marginally outperformed or, in one provider’s case, even underperformed. Recent estimates suggest that AIM IHT managers represent around £6bn of the total £70bn funds under management (FUM) on AIM. Based on data published by the providers themselves, the three largest providers account for around £2.7bn of this £6bn, or c. 45% of all managed IHT money in AIM.

Over the past three and a half years, investors in the largest AIM providers have not only struggled to outperform the benchmark, at various points in this period they have come close to falling, or have already fallen, more than 40%, completely negating their IHT benefit even before considering the upcoming tax change.

Put another way, if a client invested £100k in the each of the 4 different services on 1 January 2022, an investor in the Stellar AIM IHT Service would need to grow by 8.7% to return to its original investment value. Conversely, an investor in the largest AIM provider would need to grow by 69.5% to return to their initial investment value. Past performance is no guide to future performance, so we need to ask ourselves two obvious questions:

-

Why did Stellar outperform larger providers over the past three and a half years?

-

Would we expect these factors to have a similar impact on performance going forward?

We’ll explore both questions in more detail in our third instalment, next week.

Book a meeting to discuss your AiM portfolio with us.

To read our latest performance, or find out more about our AiM IHT Service, click here.

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Prospective investors should ensure that they read the brochure and fully understand the risk factors before making any investment decision. The value of investments and the income from them may fall as well as rise and is not guaranteed. No assurance or guarantee is given that any targeted returns will be achieved. Forecasts of potential future results are not a reliable indicator of actual future results.

Stellar Asset Management Limited of 20 Chapel Street, Liverpool, L3 9AG is authorised and regulated by the Financial Conduct Authority.