With over 600 companies to choose from, the bulk of which are below £50m market cap. (our minimum initial investment size), our sweet spot of £250m and below still gives us a large investable universe (200+ companies). The three providers we have discussed in our previous instalments are managing funds of up to nearly £1.5bn in size, and it is this size which prohibits them from investing in these smaller companies in the way that we can.

For a £1.5bn fund to invest 2% of their portfolio in a £100m market-cap company, they would have to buy 30% of the company. While it is not unheard of for AIM IHT managers to own double-digit stakes in individual companies, we believe that the concentration and liquidity risk that this adds is simply not prudent. Managers running funds of a certain size have to decide whether to:

- Own large proportions of their investee companies (up to 29.99% allowed before they would have to bid for the whole company)

- Run a less concentrated portfolio with an enormous tail of smaller holdings where they start to resemble an index tracker

- Run multiple different portfolios where the performance outcomes will differ considerably as opposed to one model portfolio all clients align to.

- Reduce the size of their fund to maintain investment integrity(!)

With regards to AIM funds, we firmly believe that size is the enemy of returns, which is why we are, as far as we know, the only manager to have pledged to cap the strategy’s AUM to retain our nimbleness, i.e. we will soft close the fund when our size prevents us from executing our investment strategy. We do not want to be in a situation where we can only own companies of a certain size or, worse yet, where we own more than 10% of any of our investee companies. At maximum capacity, we target a 3% ownership, on average, of our investee companies, with a maximum of 5%.

It’s important to note, we are not dogmatic in our market cap. focus and invest in larger companies where we believe the share price represents a good entry point for the stock. It is not that we don’t want to buy large companies, we simply want to be able to choose when we buy them. Something our larger peers are less able to do, given their size, meaning they are often buying the largest AIM companies even when they appear to be trading at unsustainably high P/Es, as they were in January 2022.

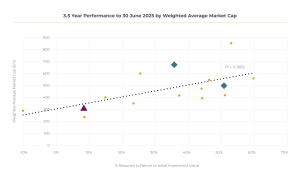

To further demonstrate the impact of an AIM manager’s size, the below chart plots the weighted average market cap. of each service (where the information was made available) against the percentage return required to return our exemplar client to their original £100k investment. Stellar is represented by the purple triangle, two large peers (the largest does not provide such data) by the blue diamonds, and the remainder represent a selection of our other peers to help demonstrate the relationship. There is a clear trend demonstrating that, for those fund managers whose portfolios have a larger weighted average market cap., performance has been worse for the three and half-year period starting 1 January 2022.

Performance as of 30 June 2025. Source: Stellar Asset Management, Industry factsheets

While three and a half years is a relatively short space of time to review performance (we ourselves believe five- to ten-years is far better for being able to conclusively demonstrate a trend), the above data highlights a key element of our outperformance versus the larger AIM IHT providers in recent times. This, we believe, is structural in nature, not merely cyclical, and so likely presents a persistent trend. It also provides an opportunity to make some informed predictions on what might happen over the next three years.

For the larger AIM IHT managers, their opportunity to demonstrate their effectiveness as an equity manager is impacted by two main factors:

- The number of companies in which they can invest, which we know is likely to be limited more to the largest companies listed on AIM, and

- Their ability to transition between different stocks as market conditions change and the outlooks for their investee companies change

In order for these larger AIM IHT providers to significantly outperform those with a broader market-cap. focus, very specific market conditions are required and also required to not change for an extended period of time. It also requires the smaller-cap. focused AIM IHT managers to not adapt their strategies to increase their portfolio’s weighted average market cap. to account for this shifting dynamic where the larger companies on AIM are structurally positioned to outperform the rest of the market over the long-term. We see these very specific set of market conditions as an extremely low probability.

In our final instalment we will explore the risks larger AIM IHT managers face when trying to exit sizeable positions, and why liquidity can become a serious constraint—particularly in times of market stress.

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Prospective investors should ensure that they read the brochure and fully understand the risk factors before making any investment decision. The value of investments and the income from them may fall as well as rise and is not guaranteed. No assurance or guarantee is given that any targeted returns will be achieved. Forecasts of potential future results are not a reliable indicator of actual future results.

Stellar Asset Management Limited of 20 Chapel Street, Liverpool, L3 9AG is authorised and regulated by the Financial Conduct Authority.