Family Trading Companies

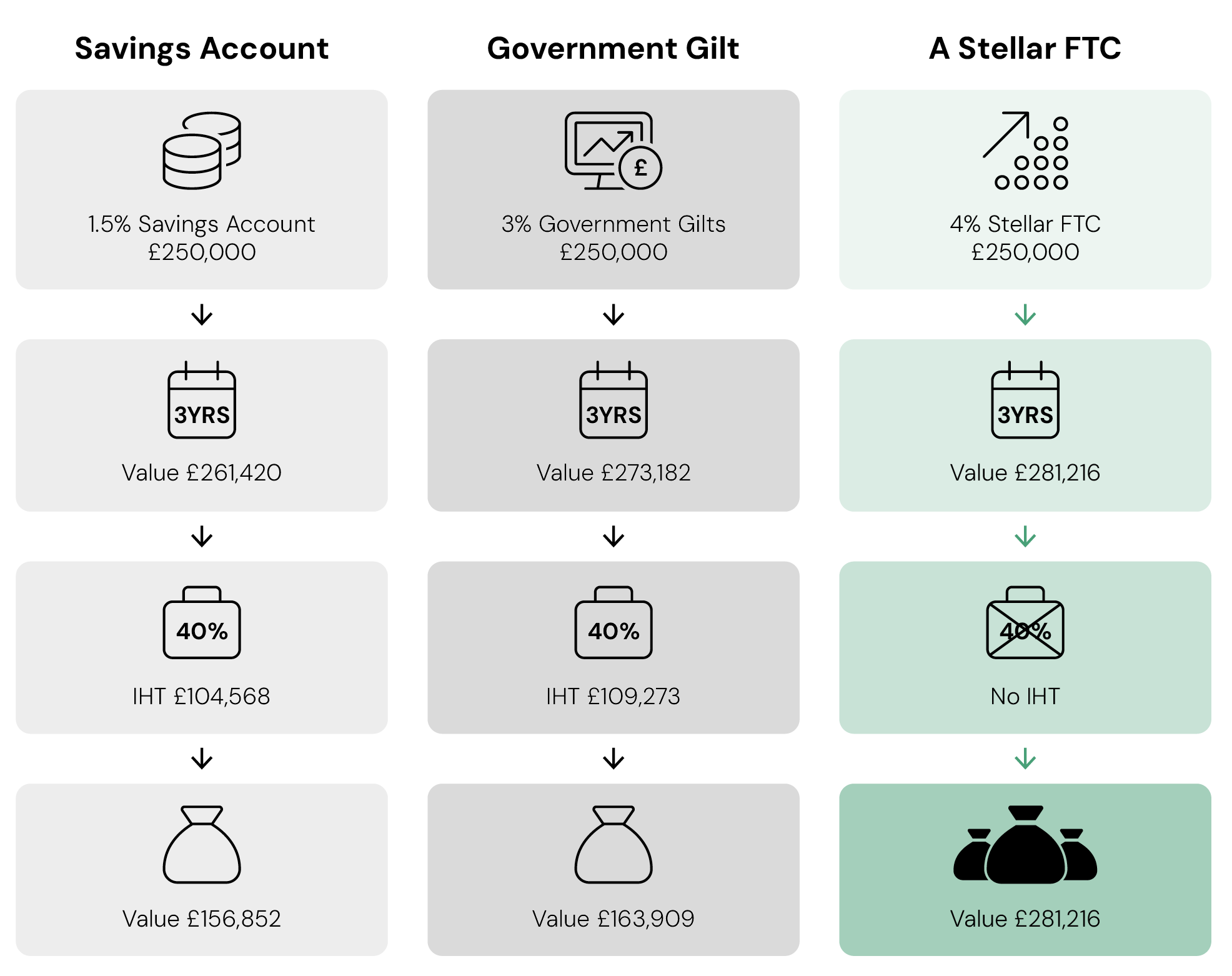

A Family Trading Company, or FTC, is a bespoke, uncomplicated, effective and trusted way of enabling you to leave a legacy for your family free from inheritance tax (IHT). Choosing a FTC as you navigate your objectives for financial security will see your money invested in real businesses, delivering tangible on-the-ground services and which create impact in social and employment terms whilst generating economic growth and benefit to you and your family.

Crucially, using an FTC will afford you certainty and provide you and your loved ones clarity about what happens to your investments and therefore your legacy when you are no longer here.

Why use a Stellar FTC?

Through our unique approach, which has worked successfully for almost 30 years, your money will go into the community and come back with profit. Houses will be built; trees will be planted and jobs will be created thanks to your FTC. Funds that are free of IHT liabilities and offer clear succession planning for your family.

We created the Service to generate wealth alongside societal impact. You will back real businesses delivering real services. We create that choice.

• If you want to see, touch and enjoy the tangible social and economic impact of your investments, you can.

• If you want healthy returns and direct control, you can.

• If you want flexibility for when circumstances change, you can.

• If you want your loved ones to have simple clarity about succession and easy access to investments, you can.

• And if you want all this free of IHT, you absolutely can.

If these are your goals, our FTC service is for you.

How does an FTC work?

Our approach involves setting up a trading company to invest your family’s capital in real assets such as hotels, commercial property and forestry, affording the added attraction of asset security and social impact – specifically employment and community cohesion. An FTC does not invest in equities or gilts or bonds.

Your FTC will build homes for people and their families, conserve and enhance the natural environment, and create fulfilling jobs for local people. Moreover, your funds will become free of IHT liabilities and offer clear succession planning for your family.

Key Features

Tax efficiency

Relief from IHT after two years.

Diversified

Investment in assets across a wide range of qualifying business activities.

Control

Retain ownership of investments, to provide full control.

Lasting Legacy

Provides confidence and reassurance today and in the future.

Uncapped returns

Offers uncapped returns from qualifying business activities.

Growth

Targeted returns of between 3% and 4.5% per annum (net of fees).