The Stellar ITS

The Stellar ITS is a discretionary managed service which is designed for investors who wish to leave a legacy that is free from inheritance tax. It provides access to a range of qualifying business activities that offer security and diversification, whilst seeking capital growth, in addition to qualifying for Business Relief.

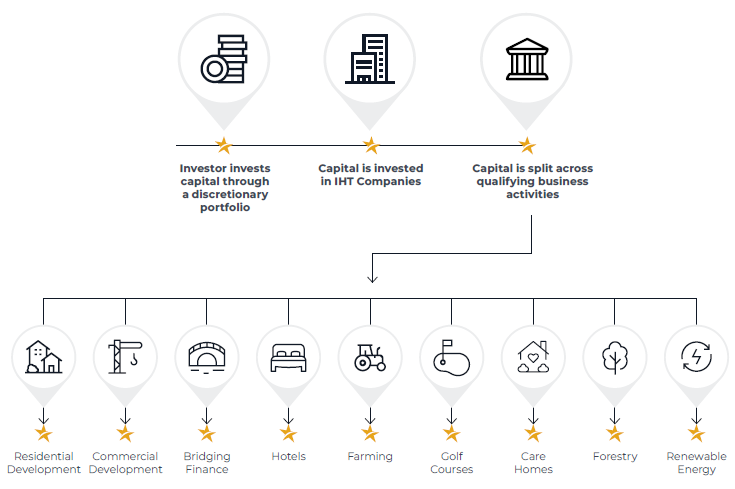

All of these qualifying business activities are carefully selected for both their low-risk characteristics and ability to generate capital growth. The Stellar ITS operates across a range of different investment sectors including Commercial Forestry, Hotels, Bridging Finance and, Residential and Commercial Property Development.

You and your beneficiaries should benefit from 100% inheritance tax relief – provided that the portfolio is held for a minimum of two years, and at the time of death.

Why use The Stellar ITS?

Our inheritance tax services are backed by Business Relief legislation, meaning that you can pass capital to your beneficiaries with 100% inheritance tax relief, whilst also keeping complete control of your capital – as long as you have held the portfolio for at least two years, and at the time of death.

The Stellar ITS is a discretionary managed portfolio which commits your capital to a range of investment sectors that offer security and diversification. It has also been designed to provide capital growth, in addition to relief from inheritance tax as described above.

All of the qualifying business activities are carefully selected for both their low-risk characteristics and ability to generate growth. Please note that there is a minimum subscription amount of £25,000, but no upper limit.

How does The Stellar ITS work?

When you invest in the Service we set up a discretionary portfolio in your name, which then invests in a range of qualifying business activities through IHT Companies.

You are the beneficial owner of the shares in the IHT Companies, which are held through a nominee, so that you keep control of your capital.

Key Features

Tax efficiency

Relief from IHT after two years.

Diversified

Investment in assets across a wide range of qualifying business activities.

Control

Retain ownership of investments, to provide full control.

Lasting Legacy

Provides confidence and reassurance today and in the future.

Uncapped returns

Offers uncapped returns from qualifying business activities.

Growth

Targeted returns of between 3% and 4.5% per annum (net of fees).