Stellar AiM IHT Service

The Stellar AiM IHT Service is a discretionary managed service, which is designed for investors who wish to leave a legacy free from inheritance tax. Capital is invested in a diversified portfolio of between 25 and 40 companies which are quoted on the Alternative Investment Market (AiM) of the London Stock Exchange. You and your beneficiaries should benefit from 100% inheritance tax relief – provided that the portfolio is held for a minimum of two years, and at the time of death. Investors can also invest in the Service through an ISA wrapper. An ISA is one of the most popular ways to save and affords tax free income and tax free capital gains in addition to the IHT relief.

Why use AiM IHT Service?

We see particular value in the smaller end of AiM (companies with a market capitalisation below £250m) which is less researched,owned, and offers more potential pricing anomalies to exploit.

We want to buy the best AiM companies,not mearly the biggest. By getting in before larger peers, we seek to acquire cheaply andas the company grows it attracts larger and larger investors who typically push up the valuation. This provides a powerful boost shareholder returns as they benefit from underlying earnings growth as well as highe rPrice/Earnings ratio.

While the bias of the portfolio will be to the sub-£250m segment, the Service can and will invest in larger stocks where a compelling opportunity exists.

How does the AiM IHT Service work?

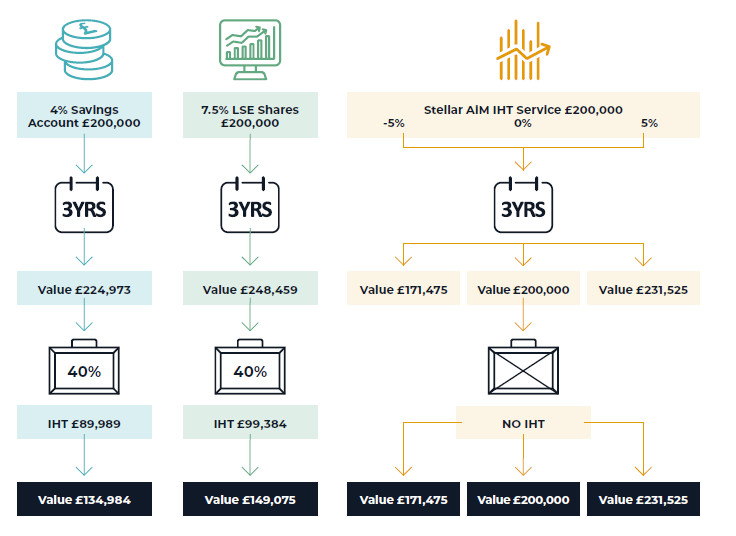

The following table illustrates how an investment in the Service might compare over three years to holding cash in a savings account, or with an investment in a portfolio of stocks in the main market of the London Stock Exchange – assumed to return 7.5% per annum.A range of potential annual returns is shown for the Service.

Key features of our Stellar AiM IHT Service

Tax Efficiency

Relief from IHT after two years

Transparent Fees

Our fees are competitive and transparent

Heritage

Long term track record

Choice

Available within GIA or ISA accounts and via wrap platforms

Diversified

The portfolio typically comprises 25 to 40 AiM listed companies

Reducing Exposure

No more than 7.5% exposure to each individual company

Control

Retain ownership of your investments, so you keep contro