Since the UK government’s budget announcement in October 2024, the upcoming reduction from 6 April 2026 in Inheritance Tax (IHT) relief obtainable for investors in companies listed on the Alternative Investment Market (AIM) to a maximum of 50% relief (i.e. an effective rate of 20% on the value of their assets) has given prospective investors pause for thought when considering investment on AIM. Additionally, lack of clarity on other key areas relating to IHT, such as the tax treatment of pensions, has left investors unable to update their asset allocations to position themselves effectively for the new, upcoming tax landscape.

For many clients, though, regardless of the changes to the IHT reliefs available through different Business Relief (BR) schemes, AIM continues to play a valuable role in their estate planning, offering diversification, flexibility, control, and attractive potential investment returns, particularly where an investor may have already used their £1m allowance through other non-AIM BR schemes.

In such cases, 50% relief on IHT is still a generous relief, and the control over the investments which AIM BR schemes offer investors whilst also allowing for speedier qualification than other avenues, such as gifting, AIM remains an attractive solution to many high-net-worth (HNW) clients. In a world of often complex and opaque solutions, AIM remains a simple and cost-effective solution. AIM shares can also be held within an ISA, further embellishing its tax efficient credentials.

In a marketplace with nearly 40 providers, these changes to BR have brought into sharp focus the need for investors to demand more from their chosen provider. The fallacious argument that AIM investors will still be better off as long as their portfolios fall less than 40% shows an astonishing lack of belief in the potential for growth on AIM and their own ability as equity fund managers.

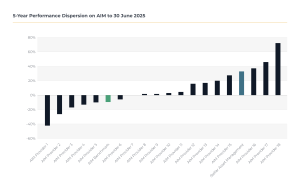

Like all good equity markets, AIM offers investors the potential to consistently grow the value of their assets over the long-term but, when reviewing historical performance, the dispersion between different AIM providers has been vast, with many failing to beat the benchmark in the past 5 years, let alone provide their investors with a positive return.

Performance as of 30 June 2025. Source: Stellar Asset Management, Industry factsheets

The reasons for differing performance amongst providers are myriad. Like with any equity fund, stock picking relies on numerous factors for success, such as quality of research, analytical skills, timing of investment, and that most ineffable of factors, dumb luck. AIM, however, is unique in the sense that there are also several structural factors that impact AIM fund managers, specifically, and we believe that the upcoming changes to the IHT rules presents an opportune time to highlight these factors, their historical impact, and how they could impact investors going forward.

On AIM, the playing field is not level for all participants. Perversely though, unlike the Premier League heavyweights that dominate English football, on AIM we find that a fund manager’s size can also be their biggest weakness, where their inability to be able to effectively diversify or execute trades at the speed of their smaller counterparts can lead to chronic underperformance.

Stay tuned for the second weekly instalment of our four-part series where we will explore these detrimental outcomes in greater detail and explain why they happened and, more importantly, why they are likely to continue to happen.

Book a meeting to discuss your AiM portfolio with us.

To read our latest performance, or find out more about our AiM IHT Service, click here.

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Prospective investors should ensure that they read the brochure and fully understand the risk factors before making any investment decision. The value of investments and the income from them may fall as well as rise and is not guaranteed. No assurance or guarantee is given that any targeted returns will be achieved. Forecasts of potential future results are not a reliable indicator of actual future results.

Stellar Asset Management Limited of 20 Chapel Street, Liverpool, L3 9AG is authorised and regulated by the Financial Conduct Authority.