Key features of The Stellar ITS

Tax efficiency

Relief from IHT after two years.

Diversified

Investment in assets across a wide range of qualifying business activities.

Control

Retain ownership of investments, to provide full control.

Lasting legacy.

Provides confidence and reassurance, today and in the future

Uncapped returns

Offers uncapped returns from qualifying business activities.

Growth

Targeted returns of between 3% and 4.5% per annum (net of fees).

The Stellar ITS is a discretionary managed service which is designed for investors who wish to leave a legacy that is free from inheritance tax. It provides access to a range of qualifying business activities that offer security and diversification, whilst seeking capital growth, in addition to qualifying for Business Relief.

All of these qualifying business activities are carefully selected for both their low-risk characteristics and ability to generate capital growth. The Stellar ITS operates across a range of different investment sectors including Commercial Forestry, Hotels, Bridging Finance and, Residential and Commercial Property Development.

You and your beneficiaries should benefit from 100% inheritance tax relief – provided that the portfolio is held for a minimum of two years, and at the time of death.

Investing in Inheritance Tax Services carries risks and is not suitable for everyone,

click here for more information on the Risks of Investing.

Key documents

Supporting documents

Key Benefits

Our inheritance tax services are backed by Business Relief legislation, meaning that you can pass capital to your beneficiaries with 100% inheritance tax relief, whilst also keeping complete control of your capital – as long as you have held the portfolio for at least two years, and at the time of death.

The Stellar ITS is a discretionary managed portfolio which commits your capital to a range of investment sectors that offer security and diversification. It has also been designed to provide capital growth, in addition to relief from inheritance tax as described above.

All of the qualifying business activities are carefully selected for both their low-risk characteristics and ability to generate growth. Please note that there is a minimum subscription amount of £25,000, but no upper limit.

View our recent performanceHow it Works

Structure

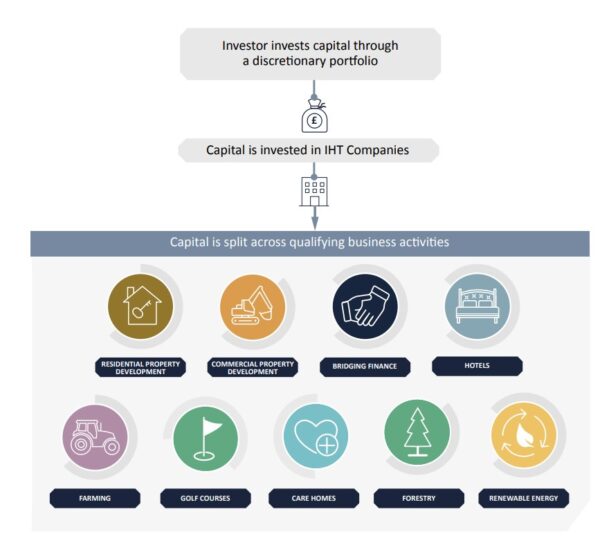

When you invest in the Stellar ITS we set up a discretionary portfolio in your name, which then invests in a range of qualifying business activities through IHT Companies.

You are the beneficial owner of the shares in the IHT Companies, which are held through a nominee, so that you keep control of your capital.

Investing in our Inheritance Tax Services carries risks and is not suitable for everyone. Tax reliefs are subject to change and dependant upon personal circumstance.

There is no guarantee that an investor will receive a full return. Please find further details of the risks here.

Performance Comparison

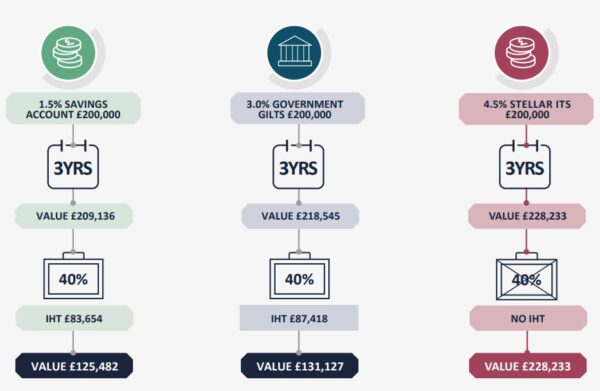

The Stellar ITS is designed to provide real returns during your lifetime, as well as a tax-efficient legacy for your beneficiaries. This graphic compares the three year performance of a savings account, government gilts and the Stellar ITS, assuming it meets its target return.

Please note:

- The Stellar ITS is higher risk than saving accounts and government gilts.

- After two years, a holding in the Stellar ITS should attract 100% relief from IHT, provided the initial investment is held at the point of death.

- All returns are calculated using annual compounding and rounded to the nearest whole pound where applicable.

Our Investment Strategy

- Offering security and diversification, the Stellar ITS Service commits each client’s capital to a range of investment sectors, as well as providing relief from inheritance tax.

- When you invest in the Stellar ITS we set up a discretionary portfolio in your name, which then invests in a range of qualifying business activities through IHT Companies. You are the beneficial owner of the shares in the IHT Companies, which are held through a nominee, so that you

keep control of your capital.

- The qualifying business activities are carefully selected for their ability to provide capital security and generate capital growth. The target return is between 3% and 4.5% per annum (net of fees). Please note that this is a target only and is not guaranteed. The target return is quoted before the effect of any adviser charges which, if paid, will reduce the target return. Please refer to the Terms to see how adviser charges may reduce the target return.

- We choose to invest in a diverse range of qualifying business activities, all of which are underpinned by physical assets. Capital preservation is the focal point of our strategy because we believe this helps to reduce risk.

Important Information

Risks

There are never any guarantees in the world of investment, so it’s essential that advisers make their clients aware of the risks. Our Inheritance Tax Services are not suitable for everyone, so here’s a summary of what an investor needs to know before getting involved – alternatively, click here for more information.

- The value of a portfolio of IHT companies, or any income derived from them, can fluctuate.

There is no guarantee that the full value of an investment will be returned, or that sufficient investments in qualifying business activities will be made within the expected timetable, or at all. - Qualifying business activities are not certain.

Qualifying business activities may subsequently cease to qualify for Business Relief. In such cases, Business Relief could be lost or delayed. - Tax reliefs are not guaranteed

The rate of tax, tax benefits and tax allowances are subject to change and are also dependant on personal circumstance. Plus, any changes to what constitutes a qualifying business activity may have a material adverse effect on the value of the business, or Stellar’s potential to achieve the objectives of the service. - Conflicts of interest

The interests of one group of investors may not coincide with another, or an interest of Stellar. In the event of a conflict, Stellar’s investment committee will work to ensure it is resolved fairly and in lie with our conflict policy. - Investments are long-term and high risk.

Interests in the IHT companies are not liquid so although you can request a withdrawal from your portfolio, there may be a delay. Exits are reviewed quarterly and there is no guarantee that an exit will be possible. Such interests are also considered to be higher risk than securities listed on LSE. - Past performance is no indicator of future success.

Fees and Charges

| Initial Subscription Fee | Nil |

| Dealing Fee | 1.0% |

| Management Fee | 0.5% plus VAT subject to Investors achieving a minimum performance of 3.5% per annum. |

| Service Fee | 1.5% plus VAT |

Take a look at our wide range of Inheritance Tax Services

Stellar AiM IHT Service

A discretionary managed portfolio that mitigates risk through a diversified selection of AiM stocks. This service is available for advised clients, on many of the UK’s largest wrap platforms.

Stellar Bespoke IHT Service

Designed for sophisticated investors who prefer a tailored discretionary investment approach to improve tax-efficiency.

Stellar Business IHT Service

A discretionary managed service which provides numerous succession planning and tax efficiency options for business owners – either following the sale of a company, or to invest excess company capital to maintain tax efficiency.