Discretionary Strategy

“We want to protect part of our estate from IHT to leave a growing legacy for our children.”

The Client

Marjorie and Sam have been clients of their adviser, Bill, for over five years. They are a couple in their seventies and have an estate of approximately £40 million. They have recently sold a commercial property and have £3 million to invest and are seeking to reduce their three childrens’ exposure to IHT whilst investing in assets that are socially responsible.

They were seeking a bespoke service where they invested specifically in their own projects and have

the flexibility to amend the investment over time. They already have an AIM portfolio with Stellar which attracts relief from IHT because they have owned their portfolio for more than two years.

Our Solution

With Bill’s help, Marjorie and Sam are keen to invest in Business Relief (BR) qualifying assets seeking to achieve 100% relief from IHT after two years.

After considering a range of BR options, Bill selects the Stellar Bespoke IHT Service because it allows a bespoke solution to structuring the investment and selecting qualifying activities that suit their needs. The couple invest in three different companies, one for each of their children. This means that each of their children will inherit a company which may be used for their own estate planning.

They are aware of the need in the UK for further housing and as a result they choose to focus on residential property development for each of the three companies established through the Stellar Bespoke IHT Service.

They are on track to secure 100% relief from IHT for their children after two years, whilst investing in tangible assets seeking to preserve and grow their legacy.

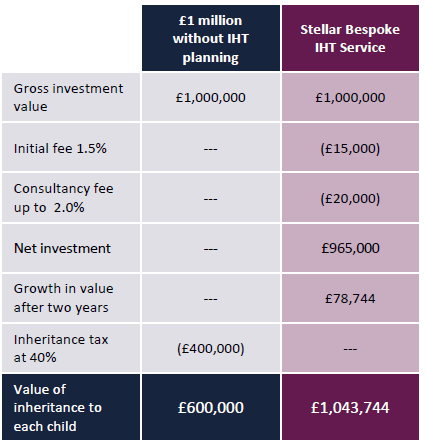

The following table illustrates the benefits of investing £1 million for each of their children sought from the Stellar Bespoke IHT solution. We have assumed the underlying investments provide growth of 4% per annum after fees.

Result after 2 years

Important Information

Stellar Asset Management Limited does not offer investment or tax advice or make recommendations regarding investments. Capital is at risk. Investments in unquoted companies are less liquid and are higher risk. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. This document is dated 10th September 2020 and is exempt from section 21 of the Financial Services and Markets Act 2000 and is not required to be and has not been approved for the purposes of the section because it is only being communicated to selected Investment Professionals (as defined under article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005). If this document is forwarded to any other person, you must ensure that you have taken responsibility for the document under the financial promotions rules and identified yourself as the issuer. Stellar Asset Management Limited of Kendal House, 1 Conduit Street, London W1S 2XA is authorised and regulated by the Financial Conduct Authority.